If you’re looking to grow your wealth while paying less tax, the UK offers several tax-efficient investment schemes that can help you maximise your returns while minimising tax liabilities. Whether you’re looking for low-risk, flexible savings or high-growth opportunities, this guide will help you navigate the best options available.

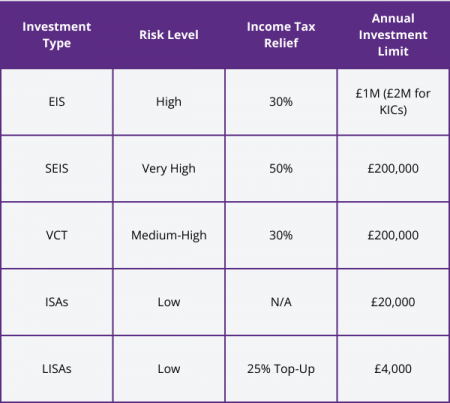

Comparison of Investment Schemes

When considering various investment opportunities, it’s important to understand the risk levels, tax benefits, and annual limits associated with each scheme. Below is a comparison of some common options available to investors.

High-Risk, High-Reward Investment

If you’re comfortable with higher risk, there are several tax-efficient options that offer substantial rewards. These investments tend to focus on early-stage, fast-growing businesses and offer significant tax reliefs in return.

Venture Capital Schemes

Venture capital schemes offer generous tax incentives and are designed to help high-risk, early-stage companies that are not listed on a recognised stock exchange secure investment.

These companies often struggle to access traditional finance, so government-backed schemes provide tax incentives to make such investments more attractive.

While these companies can offer high-growth opportunities, they can also be volatile, and specific conditions must be met to qualify for tax relief, including a minimum holding period for shares.

Enterprise Investment Scheme (EIS)

The Enterprise Investment Scheme (EIS) is well-suited for those seeking long-term, high-growth opportunities with significant tax reliefs.

Key Benefits:

-

30% Income Tax Relief:

Investors can claim back 30% of their investment in an Enterprise Investment Scheme (EIS) company as a reduction in their Income Tax bill, up to £1M per year (£2M for knowledge-intensive companies). -

No Capital Gains Tax (CGT):

Any profits made from selling EIS shares after holding them for at least three years are completely tax-free. -

Capital Gains Deferral:

If you reinvest proceeds from a capital gain into EIS shares, you can defer paying Capital Gains Tax until a later date. -

Loss Relief:

If your EIS investment makes a loss, you can offset it against your Income Tax or Capital Gains Tax to reduce your overall tax bill.

Example Calculation: Invest £10,000 in an EIS-eligible startup and receive £3,000 in tax relief.

If the investment grows to £20,000, you’ll make a £10,000 profit, which is free from CGT under EIS rules (if held for at least three years).

Seed Enterprise Investment Scheme (SEIS)

The Seed Enterprise Investment Scheme (SEIS) is for those comfortable with early-stage, high-risk investments and provides very generous tax relief. It’s designed to encourage investment in new, unquoted companies.

Key Benefits:

-

50% Income Tax Relief:

Investors can claim back 50% of their investment in a Seed Enterprise Investment Scheme (SEIS) company as a reduction in their Income Tax bill, on investments up to £200,000 per tax year. -

No Capital Gains Tax (CGT):

Any profits made from selling SEIS shares after holding them for at least three years are completely tax-free. -

50% CGT Reinvestment Relief:

When reinvesting gains from other assets into SEIS, you can reduce your Capital Gains Tax bill by 50% of the reinvested amount. -

Carry-Back Option:

You can apply SEIS tax relief to the previous tax year, potentially increasing your tax savings.

Example Calculation: Invest £10,000 in an SEIS-eligible startup and receive £5,000 in income tax relief.

If the investment grows to £20,000, you’ll make a £10,000 profit, which is free from CGT under SEIS rules (if held for at least three years).

If the investment fails, loss relief could reduce your effective risk to just £3,000 (for a 40% taxpayer).

Venture Capital Trusts (VCTs)

Venture Capital Trusts (VCTs) operate differently from EIS and SEIS. Instead of investing directly in a company, individuals invest in a managed fund that pools resources to finance multiple unquoted businesses.

VCTs are for those seeking a diversified, managed investment with attractive tax benefits. However, they carry a higher investment risk.

Key Benefits:

-

30% Income Tax Relief:

Investors can reduce their Income Tax bill by 30% of the amount invested in a Venture Capital Trust (VCT), up to £200,000 per tax year. -

Tax-Free Dividends:

Any dividends earned on the first £200,000 invested in VCT shares are completely tax-free. -

No Capital Gains Tax (CGT):

Profits from selling VCT shares are exempt from Capital Gains Tax, provided they are held for at least five years.

Example Calculation: Invest £10,000 in a VCT and receive £3,000 in tax relief.

If the investment grows to £20,000, you’ll make a £10,000 profit, with no CGT to pay, and enjoy tax-free dividends, meaning you keep 100% of your dividend income—provided you hold the shares for at least five years.

Low-Risk, Flexible Investment

If you’re more risk-averse, low-risk options like ISAs offer tax-free growth with greater flexibility. These are ideal for those seeking stability while still benefiting from tax-efficient investment.

Individual Savings Accounts (ISAs)

ISAs are one of the simplest, low-risk ways to invest in the UK. They’re ideal for anyone looking for secure, long-term savings.

You can also choose a Lifetime ISA (LISA) to save for your first home or retirement with a 25% government bonus or a Junior ISA to build a tax-free savings pot for your child’s future.

The interest you earn you earn in your ISA isn’t taxable, so it won’t use up any of your Personal Savings Allowance. And they’re free from Income Tax and Capital Gains Tax (CGT).

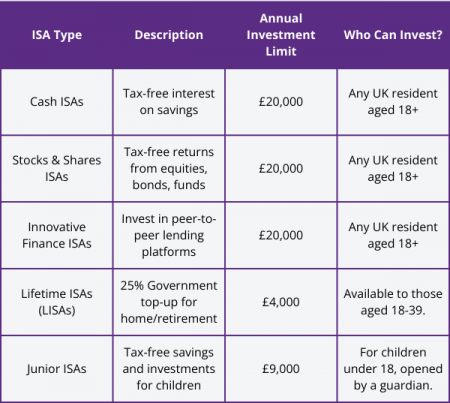

Comparison of Saving Accounts

When exploring different types of savings accounts, it’s crucial to consider the specific features, annual limits, eligibility, and withdrawal conditions. Below is a detailed comparison of the various ISA options available.

It’s worth noting that withdrawals can be made at any time without losing tax benefits, except for the Lifetime ISA (LISA), where non-qualifying withdrawals (those not used for a first-time home purchase or retirement) incur a 25% penalty.

Choosing an Investment Scheme

Choosing the right tax-efficient investment strategy depends on your financial goals, risk tolerance, and investment timeline.

While ISAs offer a secure and flexible way to grow your savings tax-free, venture capital schemes like EIS, SEIS, and VCTs provide opportunities with significant tax reliefs, albeit with higher risk.

At Atek, we’re here to provide expert tax advice and ensure you’re taking full advantage of all tax-efficient allowances and expenses in the UK. Contact us today to discuss!

More resources: